While most banks offer multiple avenues to pay your credit card bill, it’s hard to pay an Apple Card balance without an iPhone. That’s because Apple doesn’t have physical banking locations or an Android app for bill payments. Thankfully, you don’t need an iPhone or any other Apple product to pay your Apple Card balance.

AppleCard Payments Tutorial – Easy! Quick! Transparent!

Set up scheduled recurring payments

You can set up recurring payments toward your Apple Card balance and choose the amount and schedule.

- Pay My Bill: Pay your entire monthly balance on a specific date every month.

- Pay Minimum: Pay the minimum balance on a specific date every month.

- Pay Different Amount: Pay a specific amount weekly, every two weeks, or monthly.

Note: If you need to change the details of a scheduled payment, such as the payment amount, cancel the scheduled payment and create a new one. See View or cancel scheduled payments.

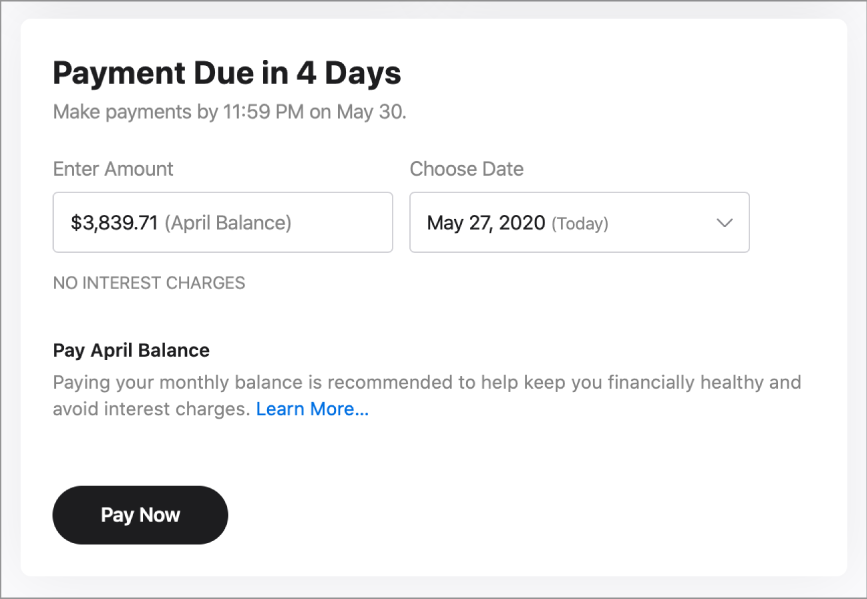

You can make an immediate, one-time payment toward your Apple Card balance, or you can schedule a one-time payment for the future.

- If you select today’s date: Click Pay Now.

- If you select a date in the future: Click Pay Later.

Find your minimum payment due

The minimum payment is the minimum amount you must pay towards your Apple Card balance to keep your account current.

When your minimum payment is due, Payment Due appears with the amount below your Apple Card. If you bought an iPhone, iPad, Mac, or other eligible Apple product with Apple Card Monthly Installments, your monthly installment is included in the minimum payment amount.

You can set up recurring scheduled payments or make a one-time payment in the Wallet app with just a few taps. If you dont have an eligible iPhone or iPad, you can make an Apple Card payment online at card.apple.com.

For Apple Card Family, account owners and co-owners are responsible for all payments on the shared Apple Card account. On a co-owned account, each co-owner can make payments on the account and can add a bank account. Before making or scheduling a payment on a shared Apple Card account, co-owners should verify that the correct bank account is selected.3

Ways to Make an Apple Card Payment

A credit card billing cycle is the period of time between two credit card statements, usually lasting 28-31 days. On the last day of a credit card’s billing cycle – also known as the closing date –the card’s issuer will compile the account’s billing statement. This includes a bill for all the charges made to your account during that billing cycle, minus any payments made. You can find the starting and ending dates for your credit card’s billing cycle on your monthly statement.… read full answer

Understanding your credit card’s billing cycle is important for a few reasons. First, it’s important because your statement balance – the amount you have to pay by the due date to avoid interest – is comprised of purchases made during the billing cycle. The statement balance also gets reported to credit bureaus each month and factors into your credit utilization.

Secondly, the start and end of a billing cycle determine when you have to pay for a given purchase or fee. For example, if you purchase a big TV the day before your statement closing date, you’ll owe that money on your next due date – usually about 25 days later, or however long your grace period is. However, if you buy the TV the day after your statement closing date, it will land on the next statement. So you won’t have to pay for the TV until that statement’s due date, which could be 50 or so days later. For those budgeting out big purchases, timing the purchase to get an extra few weeks to pay can make a huge difference.

Billing cycles are also important if you are taking advantage of a 0% APR intro period. These zero-interest periods are sometimes measured in billing cycles, rather than months. This difference can be worth calculating if the billing cycle is shorter than a typical month, and you are tracking how much time you have to pay off a purchase before the promotional APR period ends.

It takes 1 to 3 business days for a credit card payment to post to your account if you pay online or by phone. Payments by mail will take a few days longer. If your credit card is linked to your checking account and both accounts are from the same bank, your payment may post immediately following the transaction. Your issuer’s payment timelines are included in your monthly statement, or you can call customer service for more information.… read full answer

In order to understand how long it takes an issuer to post your credit card payments, it’s important to know the difference between “credited,” “posted,” and “cleared.” When you submit a payment, the amount is credited, meaning the issuer recognizes you paid it. But it may not post, or be reflected in your available credit, for another day or two. When a payment is cleared, the issuer has actually received the money. As long as your payment is at least credited by the due date, it’s considered on time, assuming the transaction goes through.

To avoid any worry about how long it will take for a credit card payment to post, set up your account for autopay. This feature automatically debits your bank account for a pre-determined amount on the card’s payment due date. As long as you have enough money in the account to cover the transaction, your payments will never be late. You should be able to set up autopay online or by calling your issuer’s customer service department.

The best time to pay a credit card bill is a few days before the due date, which is listed on the monthly statement. Paying at least the minimum amount required by the due date keeps the account in good standing and is the key to building a good or excellent credit score. That’s true for everyone, but some people might want to take things a step further, particularly cardholders carrying balances from month to month and people with high credit utilization.… read full answer

If you have a credit card balance that you carry from month to month, it’s best to pay that credit card’s bill as soon as the monthly account statement becomes available. This will save you money on interest. Paying the card’s monthly bill in full for two consecutive months will also reduce your interest charges by reinstituting your account’s grace period. Instead of purchases beginning to accrue daily interest charges right after you make them, you will have a window between when your monthly statement becomes available and when your bill is due to pay with no interest.

If the balance listed on your monthly credit card statements consistently equals more than 30% of the card’s credit limit, consider paying your bill multiple times per month. Paying once in the middle of the month and again before the due date will reduce the balance listed on your statement. That, in turn, will lower your credit utilization, which should help your credit score.

Here’s a quick example: You have a credit card with a limit of $1,000. You charge $500 to it, using up 50% of your credit. Then, you make a payment of $300 before the billing period closes and your statement is generated. That brings your statement balance to $200 and your utilization to 20%. Paying off the final $200 before the due date then keeps your account in good standing.

FAQ

How do I pay my Apple Card bill online?

How do I pay my Apple credit card balance?

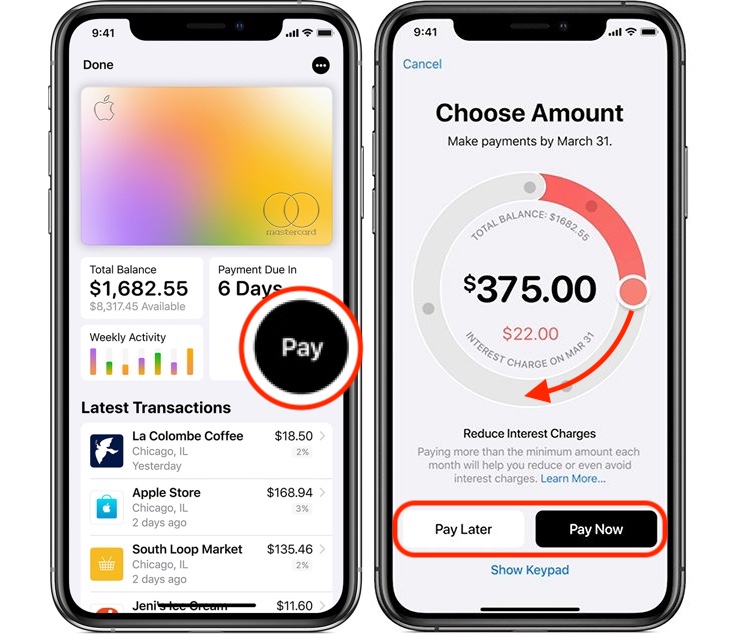

- Open Wallet on your iPhone, tap Apple Card, then tap the Pay button.

- Your monthly balance is automatically selected and the wheel turns green with a checkmark .

- Tap Pay Now to pay your monthly balance immediately. Or you can tap Pay Later.

How do I pay my apple monthly card?

- Open the Wallet app and tap Apple Card.

- Tap the more button , then tap Monthly Installments. …

- Tap Pay Early, then tap Continue.

- Choose an amount to pay, then tap Pay Now or Pay later and follow the instructions on your screen.

How do I access my Apple Card account online?

- Go to card.apple.com.

- Sign in with your Apple ID and password. For more information about Apple ID, see the Apple ID Support website. Note: If you have Apple Card Family* set up, the account owner and co-owner can sign in at card.apple.com.