@WalletHub • This answer was first published on 12/01/16 and it was last updated on 05/04/20.For the most current information about a financial product, you should always check and confirm accuracy with the offering financial institution. Editorial and user-generated content is not provided, reviewed or endorsed by any company.

To make a T.J.Maxx Credit Card payment online, log in to your online account, go to the “Summary” tab, and click on the “Make Payment” button. From there, youll be able to confirm your payment information and send your payment. You can also pay your bill over the phone through an automated system by calling 877-890-3150. Its worth noting that you cannot pay your credit card bill at a T.J.Maxx store.

If you would rather mail in a payment, send your TJX Credit Card payment to: Mastercard Accounts P.O. Box 530949 Atlanta, GA 30353-0949

The TJX Credit Card credit score requirement is 700 or better. That means people with at least good credit have a shot at getting approved for this card.

You should note that while your credit score is an important factor, there are plenty of other things that will impact your chances of being approved for the TJX Credit Card, too. Some other key criteria include your income, existing debt load, number of open accounts, recent credit inquiries, employment status and housing status.… read full answer

Since all these criteria are taken into consideration, you might be able to get approved with a slightly lower credit score. But it’s best to wait to apply until you meet the TJX Credit Card credit score requirement. You can check your credit score for free on WalletHub.

You need fair credit to get approved for the TJX credit card, which means a credit score of 620 or above. Your credit score won’t be the only factor taken into account, however, so this is only a guideline.

With that being said, you’re right to consider a store credit card in this instance because they typically have more lenient approval requirements than general-purpose credit cards. The … read full answerKohl’s Store Card is another offer worth looking into, as it provides a 20% discount on your first purchase after account approval with no cap on how much you save.

The best way to pay off debt and raise your credit score is to repay balances with the highest interest rates first. This will reduce the overall cost of repaying the debt and make the task easier because the total amount you owe won’t be growing as fast. Always make at least the minimum payment due for each balance every month, though. Keeping all accounts current will help raise your score, or at least prevent it from going down. Beyond that, just try to budget as much as you can for paying off debt each month in order to bring your balances to zero as soon as possible.… read full answer

In addition to the overall strategy of paying off your most expensive debt first while staying current on other balances, make sure to explore options for reducing the cost of what you currently owe. If you have good credit or better, balance transfer credit cards and debt consolidation loans could help you get a lower interest rate. With a lower rate, more of your monthly payment amount can go to your principal balance, speeding up the time it takes to pay off debt.

You might also consider consolidating through a home equity loan or home equity line of credit, which offer extremely low APRs but are secured by your house. Another option is a debt management program, in which you work with your creditor(s) to set up a payment plan, often with a lower interest rate and reduced payments.

Paying off debt is good for your credit score because it reduces your debt-to-income ratio while establishing a good payment history – both of which are major factors in raising your credit score.

It may take at least a few billing periods before you’ll notice any significant improvement, though. A lot depends on your starting point as well as how responsibly you manage the rest of your finances moving forward.

To track your progress, you can sign up for a free WalletHub account and get free daily credit score updates plus personalized advice.

TJX Mastercard phone number: 1-877-890-3150. (TJX store credit card phone number: 1-800-952-6133.)

TJX Rewards Credit Card Login and Detailed Review

How To Make a Regular Online Payment

After you register and set up your online account, you can make a payment by following these steps:

Types of TJ Maxx Credit Cards

Synchrony Bank issues two branded TJ Maxx credit cards: TJX Rewards card and TJX Rewards Platinum Mastercard. The TJX Rewards card can be used at TJ Maxx, HomeGoods, Marshalls, Sierra and Homesense stores and websites. The TJX Rewards Platinum Mastercard is accepted at any business that accepts Mastercard payments.

With a TJX Rewards credit card, you can receive discounts on purchases and earn points for each purchase you make. You’ll have to keep your account in good standing to continue enjoying these perks, however. Synchrony Bank gives you three options for making a TJ Maxx credit card payment: online, by phone or by mail. Here’s everything you need to know.

By phone: Call (800) 952-6133 and enter your card information when prompted, then follow the automated prompts to make a payment. Please note …

Your TJX Rewards® credit card is issued by Synchrony Bank. The Synchrony Bank Privacy Policy governs the use of the TJX Rewards® credit card. The use of this …

Note also that you can NOT pay your TJX credit card bill inside TJ Maxx/TJX stores.) Online Account Access. Log in here to make payments and manage your account …

Updated December 20, 2021 – The Marshalls retail chain is part of the TJX Companies, which includes sister store TJ Maxx as well as Sierra and Home Goods.

FAQ

How do I pay my Marshalls bill over the phone?

How do I pay my TJX card online?

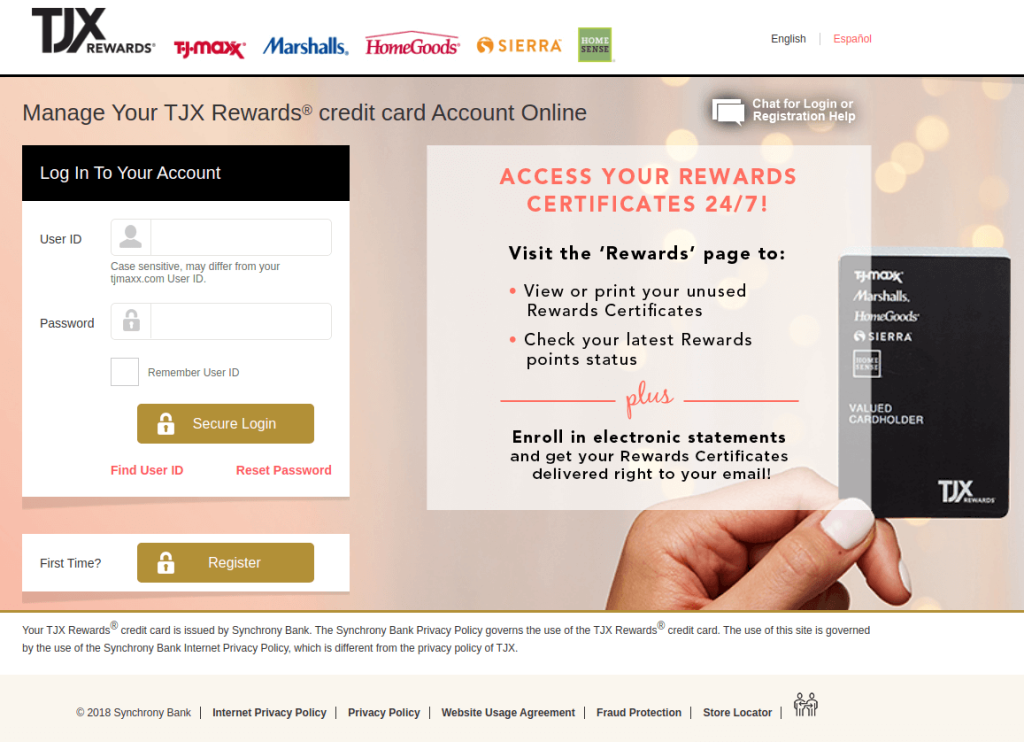

- Gather your credit card account number, bank account number and bank routing number.

- Go to the Synchrony Bank login page.

- Enter the user ID and password you selected when you registered.

- Click “Secure Login.”

- Follow the on-screen prompts to complete your payment.

Can I pay my Marshalls bill in store?

How do I pay my TJ Maxx credit card over the phone?