- Sign in to your Affirm account.

- Navigate to Pay.

- Select the purchase you want.

- Click Make one-time payment.

- Select how much you want to pay and when.

- Add or select a payment method. Click Continue.

- Review the payment amount, method, and date.

- Click Submit payment.

Never Use Affirm Or Afterpay! Lessons Learned!

How to buy with AffirmStep 1Step 2Step 3

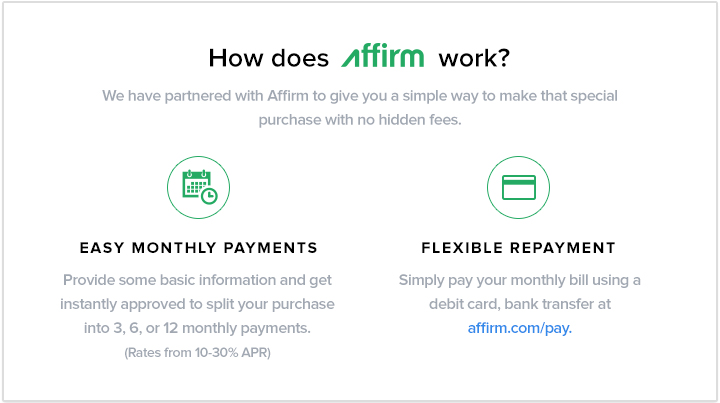

Shop your favorite stores online or in-store and pay later with Affirm. Youâll see us at checkout, or you can request a virtual card in the Affirm app.

Here’s what you might pay

Your rate will be 0% APR or 10â30% APR based on credit, and is subject to an eligibility check. Payment options through Affirm are provided by these lending partners. Options depend on your purchase amount, up to $17,500, and a down payment may be required.

Affirm provides instant funding for online and in-person purchases

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/Gettys-1212331959-6aed369fc1d04bf28661bcbca5e11155.jpg)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/Gettys-1212331959-6aed369fc1d04bf28661bcbca5e11155.jpg)

Affirm is a buy-now-pay-later company that was launched in 2012 by Paypal co-founder Max Levchin. These days, it seems to be just about everywhere, offering you the option right during the checkout process to split your purchase up into several payments over time.

Business is booming, too. Revenue was up by 55% in Q2 2021 compared to Q2 2020. Affirm is meant to be quick and easy, which means its a good idea to ensure youre not paying for convenience in the form of higher costs.

FAQ

Does Affirm hurt your credit?

Can I pay my Affirm bill early?

Can I pay my Affirm bill late?

Does Affirm let you pay bills?