Learn about how to pay your bill, how to set up auto payment, how to cancel account and contact customer support for does escrow pay supplemental tax bill by using the official links that we have provided below.

Supplemental Property Taxes: What A New Homeowner …

Supplemental Property Taxes: What A New Homeowner Should Expect

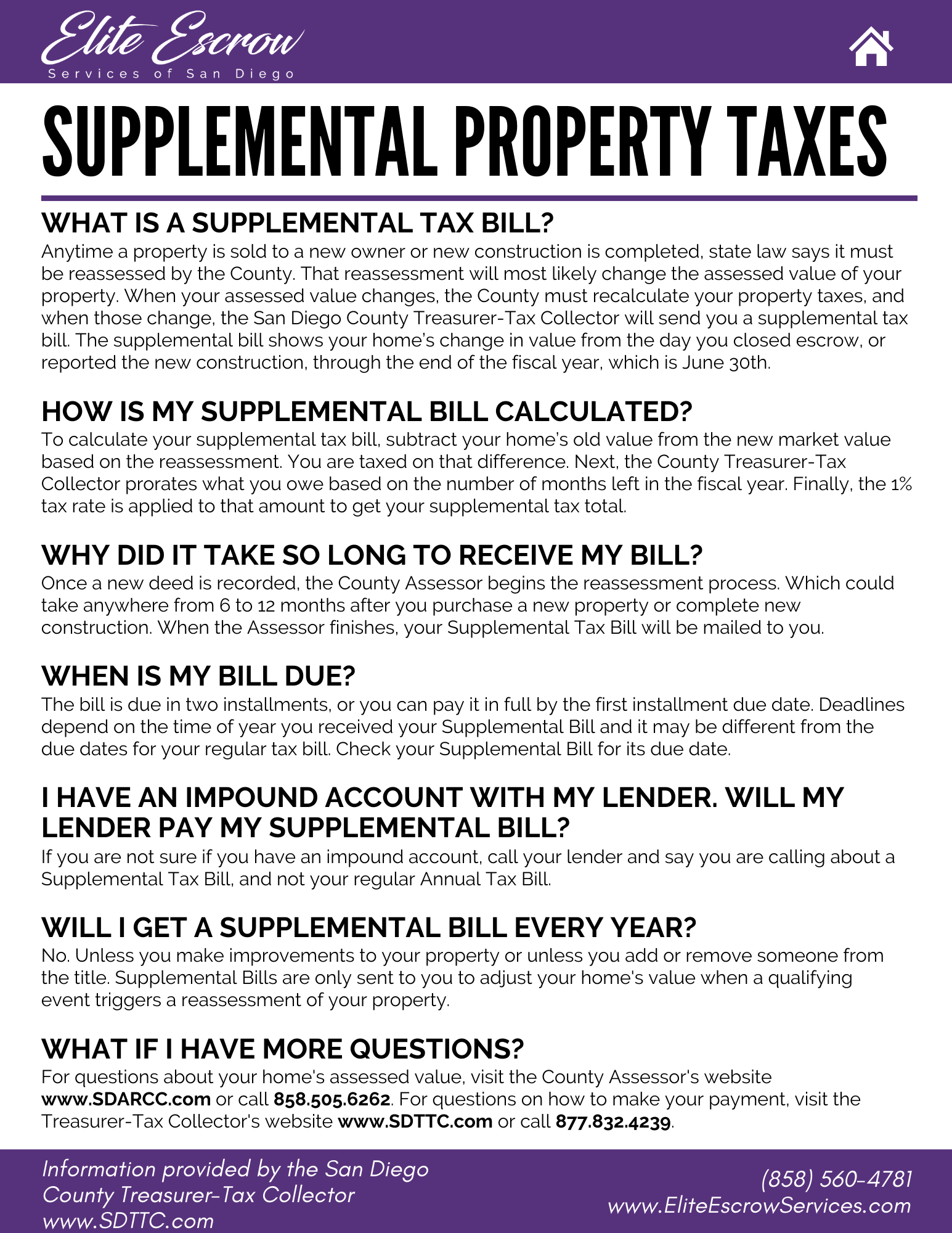

A supplemental tax bill is for additional charges not covered by the annual tax bill. Supplemental tax bills are mailed directly to the homeowner and are generally not paid out of the escrow account.

What California Homeowners Should Know About …

May 30, 2018 — A supplemental tax bill is one you get for additional charges not covered by your annual tax bill. Supplemental tax bills are mailed directly to …

Hecht Group | Can You Use Escrow Balance To Pay Supplemental …

https://www.hechtgroup.com/can-you-use-escrow-balance-to-pay-supplemental-property-tax/

Mar 03, 2022 · Each supplement tax bill is delivered in addition to a regular yearly tax bill, and they both have to be paid on time. What Is An Escrow Balance? It is your escrow balance; this is the amount of money that you have to put away in anticipation (although it is also an impoundment account in some parts of the country).

Frequently Asked Questions

Are tax bills covered by escrow?

Supplemental tax bills are also not covered by escrow accounts. These are one-time tax bills that are issued due to a change in ownership or new construction. Your lender can’t predict when you’ll get a supplemental tax bill or how much it will be. Do You Need An Escrow Account?

How do property tax payments work with escrow?

Property Tax Payments. Your lender must work directly with the county tax collector to obtain the information on your property taxes. The county sends the tax bill to the lender for review. The lender then makes a payment to the county using the money from your escrow account.

What is escrow and should you use it?

Should You Escrow Property Taxes and Insurance? – SmartAsset What is Escrow and Should You Use It? Escrow accounts help homeowners set money aside each month to cover insurance premiums and property taxes. When the bills for these come in each year, the mortgage lender uses money in the escrow account to cover the payments.

When do taxes go on escrow statement?

Your escrow statement would show taxes paid in January and July. It is also typical for a lender to keep a two month cushion on the escrow balance for property taxes and insurance premiums. How can I check if a tax payment was made for me?