Learn about how to pay your bill, how to set up auto payment, how to cancel account and contact customer support for spotsylvania treasurer bill pay by using the official links that we have provided below.

Treasurer | Spotsylvania County, VA

https://www.spotsylvania.va.us/407/Treasurer

Pay Your Bills Online … Our online payment vendor is Invoice Cloud. Visit the following websites and follow the instructions to make a one-time payment without … The Treasurer’s office prepares, mails, and collects all tax bills for real estate and personal property located in Spotsylvania County. The office is also the … Pay By Phone Information … Enjoy the convenience and flexibility of credit card payments 24 hours a day, 7 days a week. Call 1-844-443-8803. Card payment … Pay Tax Online · Tax Rates · Tax Relief Act · Taxes Paid in 2021 · Pay Your Bill Make an Online Payment · Spotsy Alert Sign Up · Redistricting 2022.

Pay Your Bills Online | Spotsylvania County, VA

https://www.spotsylvania.va.us/427/Pay-Your-Bills-Online

Treasurer Pay Your Bills Online A A Pay Your Bills Online Our online payment vendor is Invoice Cloud. Visit the following websites and follow the instructions to make a one-time payment without signing in or create an account for easier access and payment options. You may also see the balance on your account prior to making your payment.

Frequently Asked Questions

What does the Spotsylvania County Treasurer do?

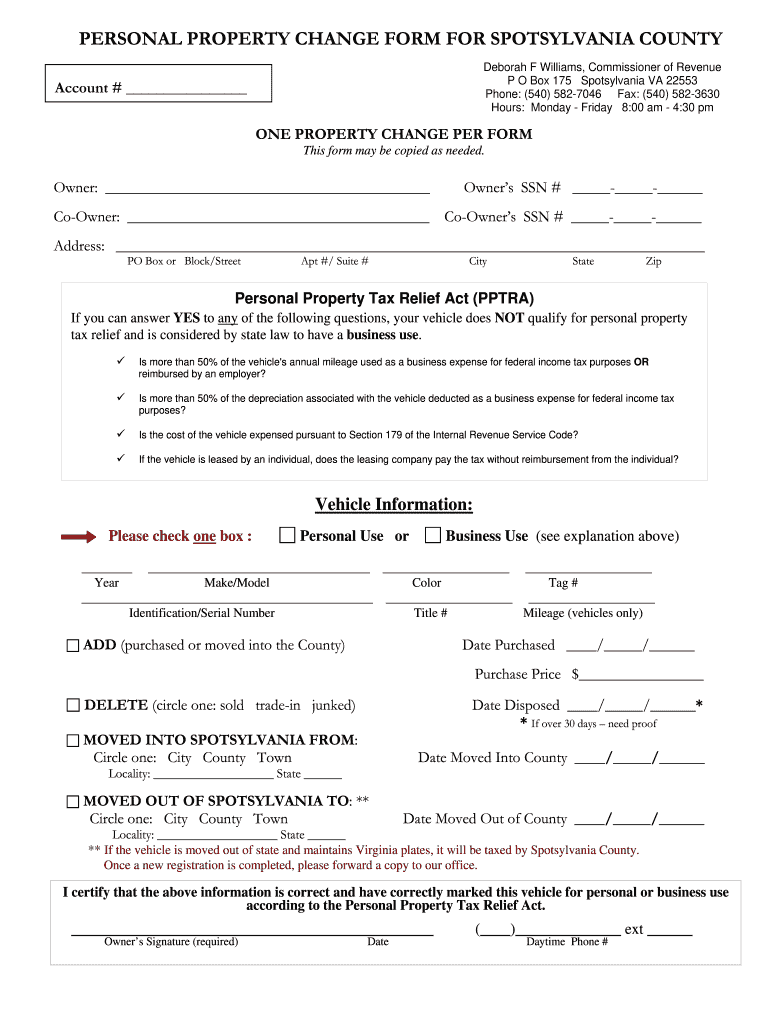

The Treasurer is a constitutional officer elected for a four-year term by general election. The Treasurer’s office prepares, mails, and collects all tax bills for real estate and personal property located in Spotsylvania County.

How can I pay my county of Spotsylvania (VA) bill?

How can I pay my County of Spotsylvania (VA) bill? You can pay them directly on this website. Or pay on doxo with credit card, debit card, Apple Pay or bank account. How can I contact County of Spotsylvania (VA) about my bill?

How do I appeal my property tax in Spotsylvania County?

As a property owner, you have the right to appeal the property tax amount you are charged and request a reassessment if you believe that the value determined by the Spotsylvania County Tax Assessor’s office is incorrect. To appeal the Spotsylvania County property tax, you must contact the Spotsylvania County Tax Assessor’s Office.

What is the gross weight of the Spotsylvania County property tax?

As of January 2017 and forward, the gross weight increased to less than 10,001 pounds. The Spotsylvania County Treasurer’s office will conduct auctions for land for sale because of unpaid real estate taxes. Look up your account information and balance.