Learn about how to pay your bill, how to set up auto payment, how to cancel account and contact customer support for marylandtaxes com bill pay by using the official links that we have provided below.

Pay It! Individual Tax Payments – Comptroller of Maryland

https://www.marylandtaxes.gov/individual/tax-compliance/pay-it.php

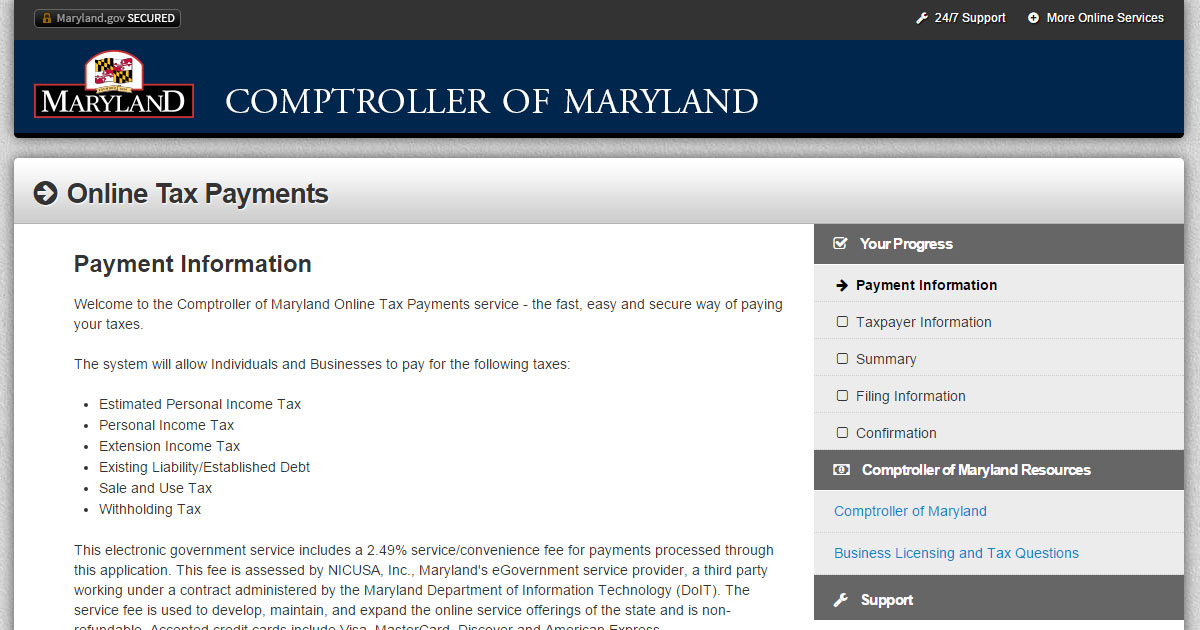

This system may be used to make bill payments on individual income tax liabilities using electronic funds withdrawal (direct debit / E-check) from a U.S. … Online Bill Pay is an easy, convenient and secure way to pay your Maryland tax liabilities online for free. This system may be used to make bill payments on … You can pay your Maryland taxes with a personal check, money order or credit card. You may also choose to pay by direct debit when you file electronically. If … This page can be used to view outstanding business tax liabilities and to make an online payment on those liabilities using electronic funds withdrawal …

Online Payment – Marylandtaxes.gov

https://interactive.marylandtaxes.gov/Individuals/Payment/

Set up a recurring debit payment / E-check for an existing payment agreement. File personal income taxes. For assistance, users may contact the Taxpayer Service Section Monday through Friday from 8:30 am until 4:30 pm via email at taxhelp@marylandtaxes.gov or by phone at 410-260-7980 from central Maryland or 1-800-MDTAXES (1-800-638-2937) from elsewhere.

Frequently Asked Questions

How do I Pay my Maryland taxes?

You can pay your tax liabilities in one of several ways, request a payment arrangement or payment plan, and adjust your withholding to make sure your employer deducts enough from your paychecks. You can pay your Maryland taxes with a personal check, money order or credit card.

What if I Don’t Know my Maryland tax payment agreement number?

With the State of Maryland recurring direct debit program you don’t have to worry about mailing off a check for your individual tax payment plan. If you do not know your payment agreement number, call our Collection Section at 410-974-2432 or 1-888-674-0016.

How do I contact Maryland taxpayer services division?

For assistance, users may contact the Taxpayer Services Division Monday through Friday from 8:30 am until 4:30 pm via email at taxhelp@marylandtaxes.gov or via phone 410-260-7980 from central Maryland or at 1-800-MDTAXES (1-800-638-2937) from elsewhere.

How do I figure the interest on my unpaid Maryland tax?

You can also use our income tax interest calculator to figure the interest on your unpaid Maryland tax. If you are unable to pay the full amount due, you should still file a return and request a payment arrangement.