Learn about how to pay your bill, how to set up auto payment, how to cancel account and contact customer support for guilford county tax department bill pay by using the official links that we have provided below.

Guilford County Tax Department

https://www.guilfordcountync.gov/our-county/tax

Online Tax Services | Guilford County, NC

https://www.guilfordcountync.gov/our-county/tax/online-tax-services

Font Size: + -. Research Tax Bills. Real Estate Appraisal Listing System. Assessments Application. On-Line Business Personal Property Listing.

Frequently Asked Questions

How do I pay property taxes in Guilford County NC?

Pay Guilford County, North Carolina property taxes online using this service. What types of tax payment are accepted? Payment is accepted in the form or cash, check, money order or credit/debit card. Taxpayers are charged 2.5% to pay by card over-the-counter and 2.4% to pay online and by phone.

Where do I mail my cheque for Guilford County taxes?

Checks for payment should be made to Guilford County Tax. Mailing address for payments is PO Box 71072, Charlotte, NC 28272-1072. What time period am I paying taxes for?

Are the billing & collections records available in Guilford County?

The Billing & Collections records provided herein represent information as it currently exists in the Guilford County tax system. This data is subject to change daily. Guilford County makes no warranties, expressed or implied, concerning the accuracy, completeness, reliability, or suitability of this data.

What forms of payment does town of Guilford accept?

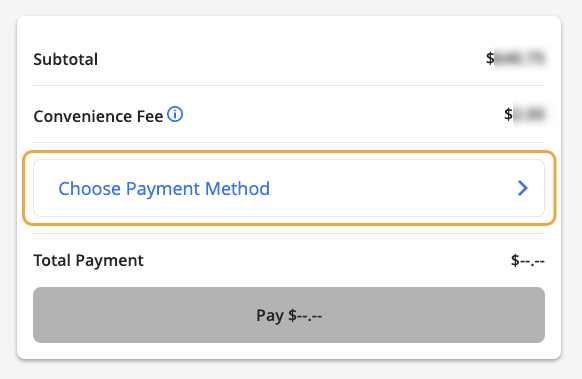

Electronic checks using a checking or savings account or the following card types are accepted for payment. Online payments will incur a convenience fee. Town of Guilford receives only your bill payment amount. Convenience fees cover various administrative costs associated with accepting payments and are non-refundable.