Learn about how to pay your bill, how to set up auto payment, how to cancel account and contact customer support for how to pay a bill in quickbooks by using the official links that we have provided below.

Bill Pay Explained: How It Works, Benefits, and Setup

https://quickbooks.intuit.com/blog/innovation/bill-pay/

How do you set up Bill Pay for QuickBooks?

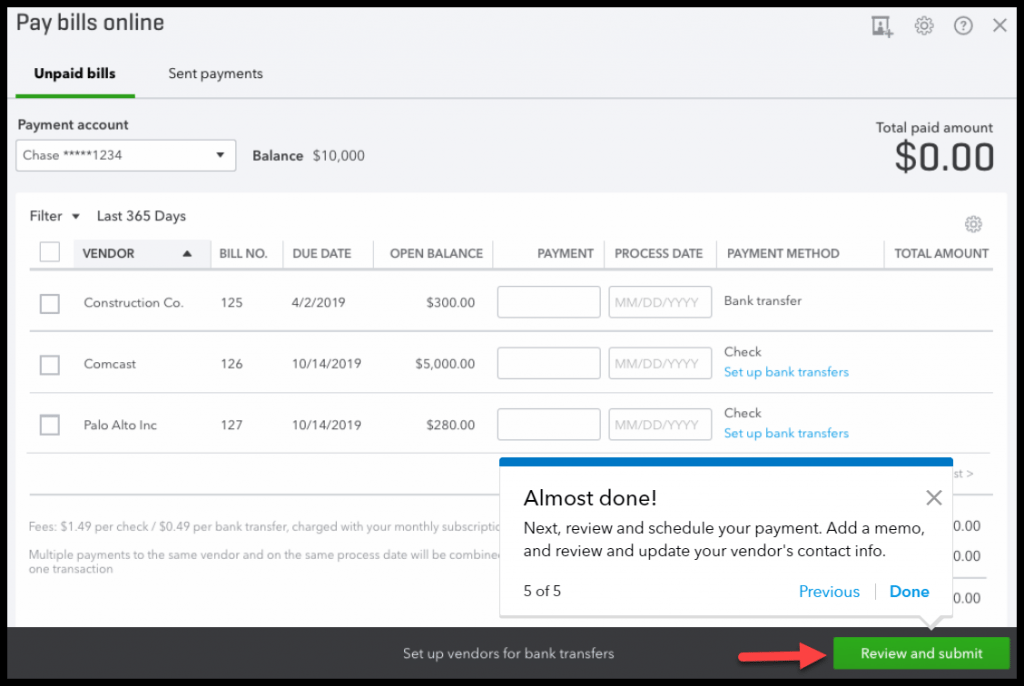

- Go to “Pay bills” in QuickBooks.

- Review the outstanding bills that need to be paid.

- Select the bill you’d like to pay.

- Select “Pay bill online.”

- Decide how you’d like to pay bills: by bank account, debit card, or credit card.

•

Pay bills in QuickBooks Desktop

Go to the Vendors menu, then select Pay Bills . · Select the correct accounts payable account from the dropdown. · Select the checkboxes of the bills you want to … Enter bills into QuickBooks · Select + New. · Select Bill . · From the Vendor ▽ dropdown, select a vendor. · From the Terms ▽ dropdown, select the bill’s terms. It’s time to pay some bills . Don’t worry – we’ll help you make short work of them. QuickBooks offers two ways to pay bills . Learn how.

Pay bills in QuickBooks Desktop – QB Community

Oct 21, 2021 · Go to the Vendors menu, then select Pay Bills. Select the correct accounts payable account from the dropdown. Select the checkboxes of the bills you want to pay from the table. …

Frequently Asked Questions

How do I pay sales taxes in QuickBooks?

To pay your sales tax:

- From the Vendors menu, go to Sales Tax, then select Pay Sales Tax.

- On the Pay From Account drop-down, select the checking account you want to use for the tax payments. …

- In the Show sales tax due through field, check and make sure the date is correct.

- In the Starting Check No. …

What are the payment methods in QuickBooks?

The answer depends on the type of electronic payment that’s being processed:

- EFT: In general, the process can take up to 3 business days.

- INTERAC e-Transfer: Depending on security features these payments are processed almost instantly or within 30 minutes.

- Credit card or debit card payments: Typically are processed within one to three business days

How to pay payroll liabilites in QuickBooks?

In QuickBooks, choose Employees > Payroll Taxes and Liabilities > Create Custom Liability Payments. In the Select Date Range For Liabilities window, set the correct dates in the From and Through fields and click OK. In the Pay Liabilities window, click the Payroll Item drop-down arrow and select the taxes you paid by credit card from the list.

When paying a bill, QuickBooks automatically?

when paying a bill, quickbooks automatically: reduces the liability (debit) and the checking account (credit) when reconciling a bank account, which of the following is considered a timing difference (difference between the bank balance and the book balance)? outstanding checks.