Learn about how to pay your bill, how to set up auto payment, how to cancel account and contact customer support for first tech bill pay by using the official links that we have provided below.

Learn How to Make Payments on Your First Tech Loan

https://www.firsttechfed.com/help/how-to-make-payments

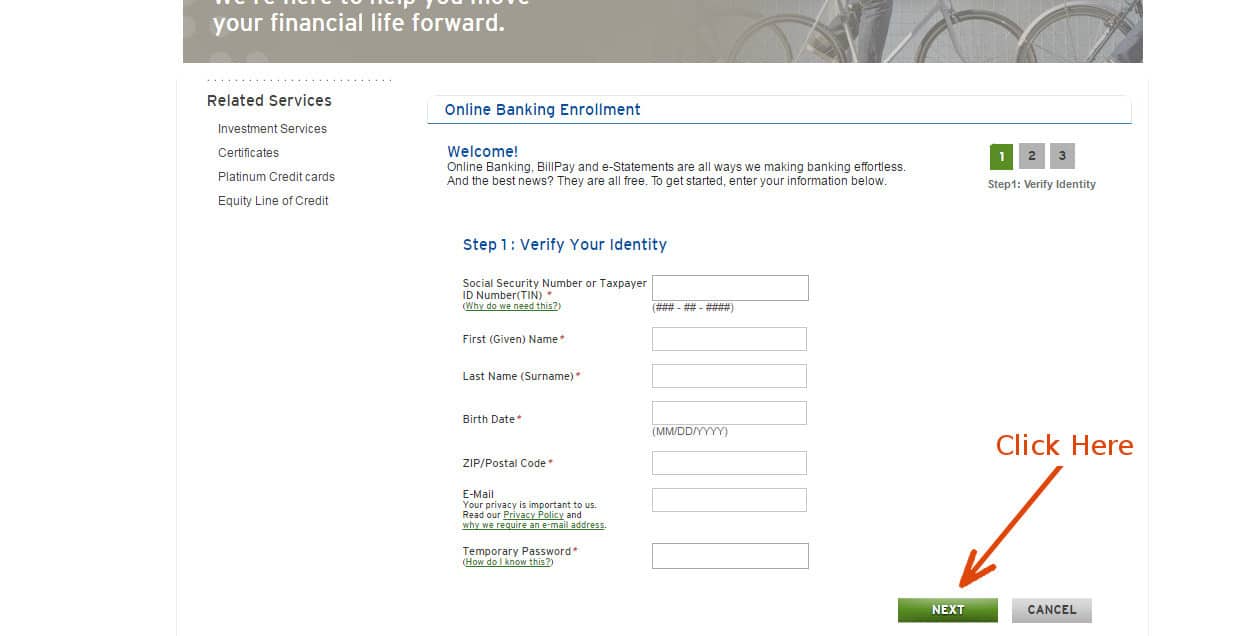

Log in to First Tech’s Online Banking or the app and follow the mobile or desktop guide to link your external accounts. Once completed, you can visit the …

Learn How to Make Payments on Your First Tech Loan

https://www.firsttechfed.com/help/how-to-make-payments

You’ll need your First Tech loan account number, First Tech’s routing number (321180373), payment due date, and First Tech’s address for loan payments. Pay by mail When you pay by mail, please include your loan account number on each check (do not send cash) and mail to the correct address for your type of loan.

Frequently Asked Questions

Which bill should you pay first?

Which debts and bills to pay first during the coronavirus outbreak

- Highest priority: Housing. Housing and related bills should be at the top of your list. …

- Medium priority: Utilities and car payments. If you’ve paid your rent or mortgage and ensured you have shelter, the next thing you’ll want to do is make sure you’re staying …

- Lower priority: Everything else. …

What is bill pay and how does it work?

eBills are electronic versions of paper bills. An eBill arrives from a biller into your Bill Pay account service the same way a paper bill arrives from a biller into your mailbox. Bill Pay allows you to view all your eBills—as well as account balances, transactions and statement information—in one convenient place.

What bills should be paid first?

The main bills you should pay first are grocery/food, child care, and essential medicine. These items should be your first priority. Although they are necessities, it’s important to be mindful of these expenses and keep them to a minimum. For example, look for opportunities to save money at the grocery store. 2.

How to pay your first bill?

- PayUSAtax: 1.96% fee with a $2.69 minimum fee

- Pay1040: 1.99% fee with $2.58 minimum fee

- ACI Payments (formerly OfficialPayments): 1.99% fee with a $2.50 minimum fee